Smart Strategies to Save on Tuition

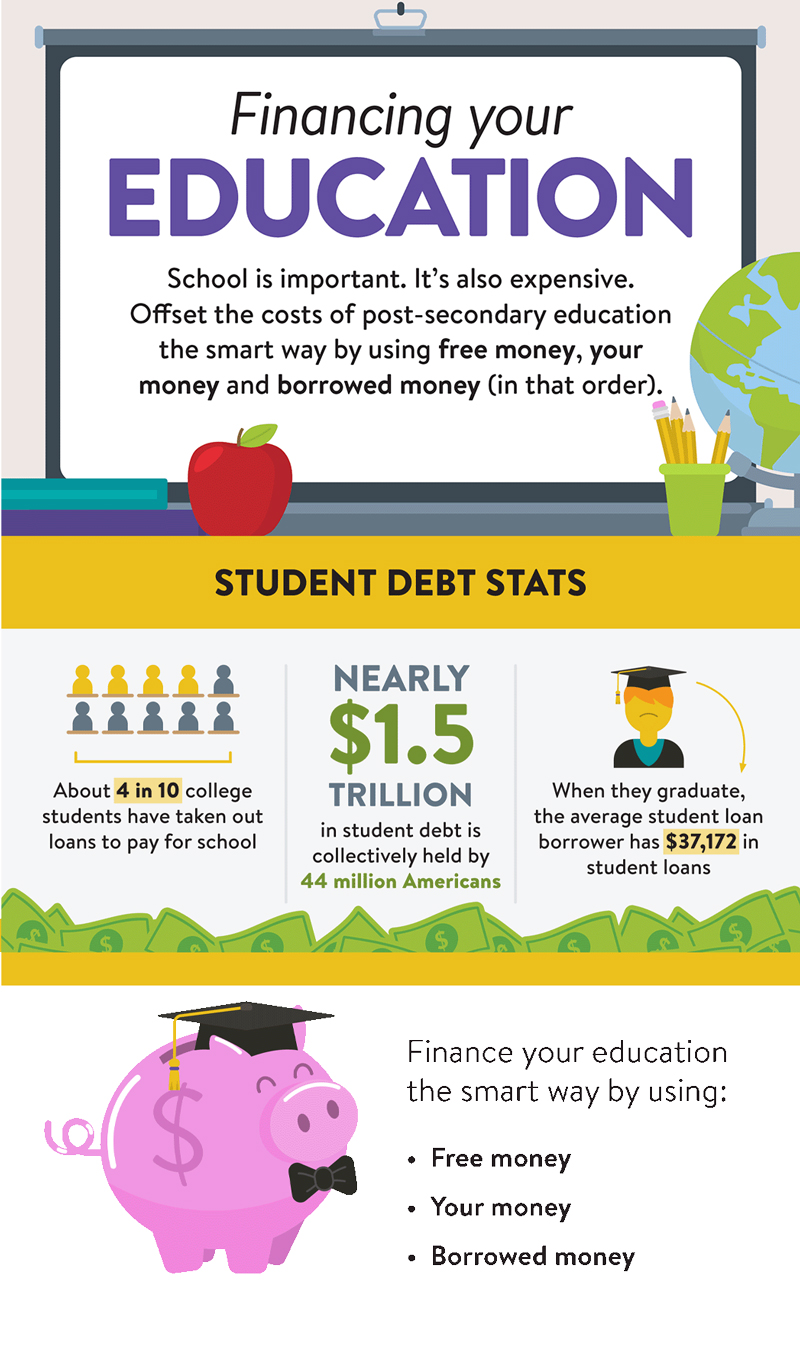

School is great, but tuition costs can put a damper on your degree dreams. Don't worry! You can learn how to find free money, make your money work harder, and borrow smarter. Check out the video below with Jen for a funny crash course in college cash management. You'll laugh, you'll learn, and you'll save big bucks.

View Infographic

Time Savers

Save on Tuition

Become a Member

Contact TruGrocer

-live-help-(1).aspx)