Introductory Offer: 1.99% APR (Annual Percentage Rate) for the first 12 billing cycles on purchases and balance transfers. No balance transfer fees apply. This offer is available on approved credit and membership is required. See VISA disclosure below for full terms and conditions.

Apply Now

GET A $100 BONUS

Spend $500 within the first 90 days of account opening and receive 10,000 bonus points = to $100 cashback!

Balance transfers do not qualify for this introductory offer.

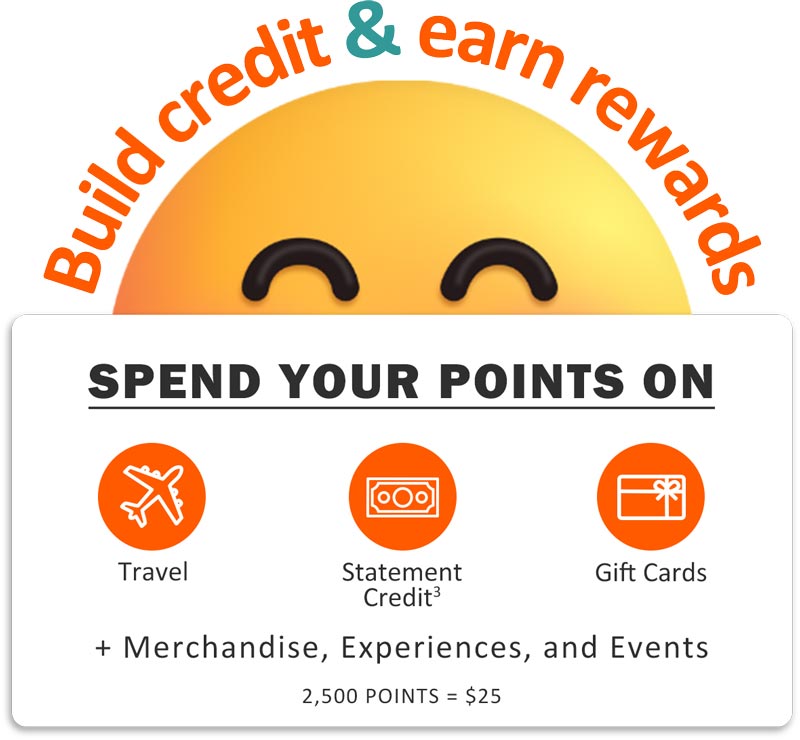

Begin your rewards journey today!

-

3x points per $1 on grocery purchases1

-

2x points per $1 on gas purchases2

-

1x points per $1 on all other purchases

Apply Now

Accepted almost anywhere with Tap and Go EMV chip for extra security.

The TruGrocer VISA® Rewards credit card gives you purchasing power and convenience at your fingertips! Use it at over 14 million different locations, wherever the VISA® logo is displayed. Use it to make purchases, and cash advances at ATMs and financial institutions worldwide4.

Add your card to your electronic wallet with Apple Pay®, Samsung Pay®, or Google pay®

TruGrocer VISA® Rewards Credit Card Features

-

No annual fee

-

No cash advance fee

-

No balance transfer fee

-

No fee to redeem rewards.

VISA Disclosure

FAQ

-

Sign your plastic cards with permanent ink immediately upon receipt

-

Commit your PIN to memory

-

Carry only the cards you plan to use

-

Store unused cards in a secure, locked space

-

Open your statement promptly and reconcile your account

-

Review all of your card transactions carefully and report anything unusual immediately

-

Take receipts with you and tear them up before they are thrown away

-

Routinely check your credit report for any unusual or unrecognizable activity

-

Notify the Post Office to put a hold on your mail when you are out of town or arrange for a trusted friend to collect your mail each day

-

Loan your cards to anyone

-

Write your PIN on your card

-

Write your card number on a personal check

-

Give pertinent personal financial information, such as account numbers, Social Security Numbers or PIN, over the phone

-

Allow your card to be taken out of your sight during a sales transaction

-

Keep your PIN written down in your wallet

This amount is listed on the card carrier, the letter to which your card was affixed, in the upper right corner. You may also view your credit line and the balance remaining for purchases and cash advances on the Account Overview page once you have logged into MyCardInfo.

You must pay this monthly minimum to keep your account in good standing. This minimum amount is clearly stated on each statement and is equal to an amount decided upon by TruGrocer FCU. Generally, the minimum amount calculation is available in your card agreement and welcome letter and can be obtained by contacting TruGrocer Federal Credit Union.

If you do not recognize a charge or feel you were billed an incorrect amount, please follow these three steps:

-

Double-check your receipts and check with other authorized card users.

-

Contact the merchant where the purchase originated.

-

If you cannot resolve your dispute with the merchant, please complete and mail or fax the appropriate form to the designated number on the Contact Us page of the Help & Info menu.

If you have any questions, please contact our customer call center by dialing 1-855-320-6460.

Your card will work in most countries. Due to fraud trends, we may restrict transactions in certain countries. We strongly recommend that you call our customer call center by dialing 1-855-320-6460 prior to your departure as a fraud protection measure.

Most times, TruGrocer FCU will grant additional users. To request this, please contact our customer call center by dialing 1-855-320-6460. They will quickly gather the necessary information from you.

If you cannot log into your account online, please use the “I Forgot My Username” or “I Forgot My Password options” displayed on the Log In page.

TruGrocer FCU may offer cash advances on your card.You may contact us by using the information on the Contact Us page of the Help & Info menu or refer to your card agreement for more information. Generally, you can use a Personal Identification Number (PIN) to withdraw at an ATM or visit a TruGrocer FCU that offers cash advances on the type of card you have been issued. Refer to your card agreement for cash advance fees, rates, and limitations.

TruGrocer FCU may have issued a PIN when your card was sent to you. If you did not receive the PIN, you can request a new one by contacting us by dialing 1-855-320-6460.

Contact TruGrocer

-live-help-(1).aspx?width=800&height=389)

Credits are posted to the Credit Card Account on the next cycle date. Please note that rewards do not count towards your minimum payment.